Gift Tax For 2024

Gift Tax For 2024 – The gift tax is an item that will not be on the radar of most taxpayers, but in special circumstances, it could impact your taxes. However, the good news is that while large gifts may require you to . Understanding the gift tax and its limits is crucial when planning your financial gifts, whether for family, friends or others. The IRS sets specific guidelines each year for how much you can .

Gift Tax For 2024

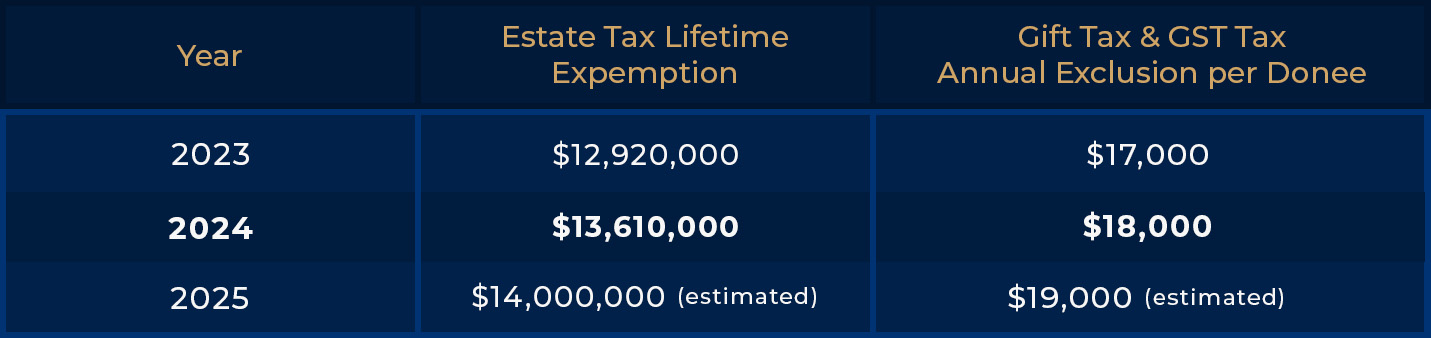

Source : smartasset.comWhat will the estate and gift tax exclusions be in 2024, 2025?

Source : www.zelllaw.com2024 Gift, Estate, and GST Inflation Adjusted Numbers Topel

Source : topelforman.comIRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates

Source : ncblpc.orgU.S. MASTER ESTATE AND GIFT TAX GUIDE (2024): CCH Tax Law Editors

Source : www.amazon.com2024 Annual Gift and Estate Tax Exemption Adjustments

Source : josephlmotta.comGift Tax Exclusion Increases for 2024: How to Get the Most Benefit

Source : www.cpapracticeadvisor.comGift Taxes in 2024: What’s Changing? YouTube

Source : m.youtube.com2024 Updates to the Lifetime Exemption to the Federal Gift and

Source : www.mblawfirm.comU.S. MASTER ESTATE AND GIFT TAX GUIDE (2024): CCH Tax Law Editors

Source : www.amazon.comGift Tax For 2024 Gift Tax, Explained: 2024 Exemptions and Rates | SmartAsset: Most taxpayers, from individuals to married couples, are unfamiliar with the concept of the gift tax, which the government assesses on certain transfers of money or other assets from one person . Unless you have given away more than $13 million in your lifetime, a $75,000 gift will not trigger the federal gift tax. Using this for a down payment also does not affect the result. A financial .

]]>