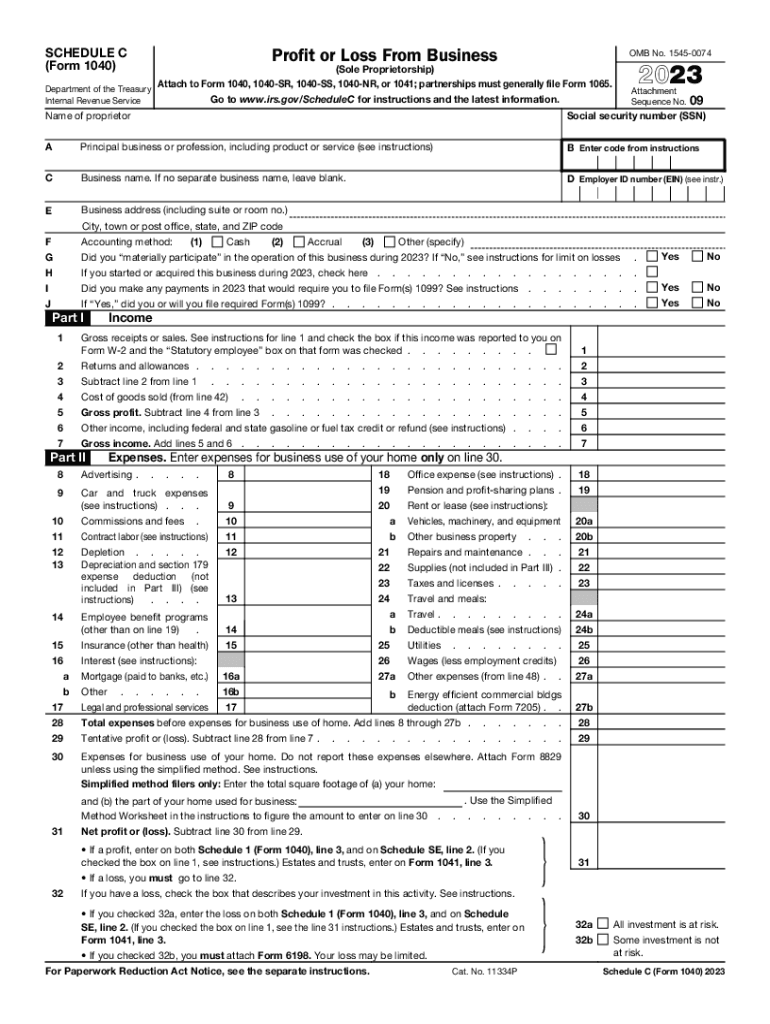

2024 Schedule C Form 1040 Irs

2024 Schedule C Form 1040 Irs – or on Schedule C (Form 1040) if from your self-employment activity,” the IRS publication 525 states. In case of stolen property, taxpayers “must report its FMV [fair market value] in your income in . For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, .

2024 Schedule C Form 1040 Irs

Source : www.nerdwallet.comHarbor Financial Announces IRS Tax Form 1040 Schedule C

Source : www.kxan.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comSchedule C (Form 1040) 2023 Instructions

Source : lili.co2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.com2023 Instructions for Schedule C

Source : www.irs.gov2024 Schedule C Form 1040 Irs What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet: The Internal Revenue Service (IRS) has released the tax refund schedule for the year 2024 the Form 1040EZ. Taxpayers who previously used this form will now be required to use Form 1040 . Gdansk, Poland – May 22, 2019: Physical Bitcoin gold coin with tax text made out of wooden they must report that income on Schedule C (Form 1040), Profit or Loss from Business (Sole .

]]>